Computational tools¶

Statistical functions¶

Covariance¶

The Series object has a method cov to compute covariance between series (excluding NA/null values).

In [156]: s1 = Series(randn(1000))

In [157]: s2 = Series(randn(1000))

In [158]: s1.cov(s2)

Out[158]: 0.019465636696791695

Analogously, DataFrame has a method cov to compute pairwise covariances among the series in the DataFrame, also excluding NA/null values.

In [159]: frame = DataFrame(randn(1000, 5), columns=['a', 'b', 'c', 'd', 'e'])

In [160]: frame.cov()

Out[160]:

a b c d e

a 0.953751 -0.029550 -0.006415 0.001020 -0.004134

b -0.029550 0.997223 -0.044276 0.005967 0.044884

c -0.006415 -0.044276 1.050236 0.077775 0.010642

d 0.001020 0.005967 0.077775 0.998485 -0.007345

e -0.004134 0.044884 0.010642 -0.007345 1.025446

Correlation¶

Several methods for computing correlations are provided. Several kinds of correlation methods are provided:

| Method name | Description |

|---|---|

| pearson (default) | Standard correlation coefficient |

| kendall | Kendall Tau correlation coefficient |

| spearman | Spearman rank correlation coefficient |

All of these are currently computed using pairwise complete observations.

In [161]: frame = DataFrame(randn(1000, 5), columns=['a', 'b', 'c', 'd', 'e'])

In [162]: frame.ix[::2] = np.nan

# Series with Series

In [163]: frame['a'].corr(frame['b'])

Out[163]: 0.013306883832198543

In [164]: frame['a'].corr(frame['b'], method='spearman')

Out[164]: 0.022530330121320486

# Pairwise correlation of DataFrame columns

In [165]: frame.corr()

Out[165]:

a b c d e

a 1.000000 0.013307 -0.037801 -0.021905 0.001165

b 0.013307 1.000000 -0.017259 0.079246 -0.043606

c -0.037801 -0.017259 1.000000 0.061657 0.078945

d -0.021905 0.079246 0.061657 1.000000 -0.036978

e 0.001165 -0.043606 0.078945 -0.036978 1.000000

Note that non-numeric columns will be automatically excluded from the correlation calculation.

A related method corrwith is implemented on DataFrame to compute the correlation between like-labeled Series contained in different DataFrame objects.

In [166]: index = ['a', 'b', 'c', 'd', 'e']

In [167]: columns = ['one', 'two', 'three', 'four']

In [168]: df1 = DataFrame(randn(5, 4), index=index, columns=columns)

In [169]: df2 = DataFrame(randn(4, 4), index=index[:4], columns=columns)

In [170]: df1.corrwith(df2)

Out[170]:

one 0.344149

two 0.837438

three 0.458904

four 0.712401

In [171]: df2.corrwith(df1, axis=1)

Out[171]:

a 0.404019

b 0.772204

c 0.420390

d -0.142959

e NaN

Data ranking¶

The rank method produces a data ranking with ties being assigned the mean of the ranks for the group:

In [172]: s = Series(np.random.randn(5), index=list('abcde'))

In [173]: s['d'] = s['b'] # so there's a tie

In [174]: s.rank()

Out[174]:

a 2.0

b 3.5

c 1.0

d 3.5

e 5.0

rank is also a DataFrame method and can rank either the rows (axis=0) or the columns (axis=1). NaN values are excluded from the ranking.

In [175]: df = DataFrame(np.random.randn(10, 6))

In [176]: df[4] = df[2][:5] # some ties

In [177]: df

Out[177]:

0 1 2 3 4 5

0 0.106333 0.712162 -0.351275 1.176287 -0.351275 1.741787

1 -1.301869 0.612432 -0.577677 0.124709 -0.577677 -1.068084

2 -0.899627 0.822023 1.506319 0.998896 1.506319 0.259080

3 -0.522705 -1.473680 -1.726800 1.555343 -1.726800 -1.411978

4 0.733147 0.415881 -0.026973 0.999488 -0.026973 0.082219

5 0.995001 -1.399355 0.082244 -1.521795 NaN 0.416180

6 -0.779714 -0.226893 0.956567 -0.443664 NaN -0.610675

7 -0.635495 -0.621647 0.406259 -0.279002 NaN -1.153000

8 0.085011 -0.459422 -1.660917 -1.913019 NaN 0.833479

9 -0.557052 0.775425 0.003794 0.555351 NaN -1.169977

In [178]: df.rank(1)

Out[178]:

0 1 2 3 4 5

0 3 4 1.5 5 1.5 6

1 1 6 3.5 5 3.5 2

2 1 3 5.5 4 5.5 2

3 5 3 1.5 6 1.5 4

4 5 4 1.5 6 1.5 3

5 5 2 3.0 1 NaN 4

6 1 4 5.0 3 NaN 2

7 2 3 5.0 4 NaN 1

8 4 3 2.0 1 NaN 5

9 2 5 3.0 4 NaN 1

Note

These methods are significantly faster (around 10-20x) than scipy.stats.rankdata.

Moving (rolling) statistics / moments¶

For working with time series data, a number of functions are provided for computing common moving or rolling statistics. Among these are count, sum, mean, median, correlation, variance, covariance, standard deviation, skewness, and kurtosis. All of these methods are in the pandas namespace, but otherwise they can be found in pandas.stats.moments.

| Function | Description |

|---|---|

| rolling_count | Number of non-null observations |

| rolling_sum | Sum of values |

| rolling_mean | Mean of values |

| rolling_median | Arithmetic median of values |

| rolling_min | Minimum |

| rolling_max | Maximum |

| rolling_std | Unbiased standard deviation |

| rolling_var | Unbiased variance |

| rolling_skew | Unbiased skewness (3rd moment) |

| rolling_kurt | Unbiased kurtosis (4th moment) |

| rolling_quantile | Sample quantile (value at %) |

| rolling_apply | Generic apply |

| rolling_cov | Unbiased covariance (binary) |

| rolling_corr | Correlation (binary) |

| rolling_corr_pairwise | Pairwise correlation of DataFrame columns |

Generally these methods all have the same interface. The binary operators (e.g. rolling_corr) take two Series or DataFrames. Otherwise, they all accept the following arguments:

- window: size of moving window

- min_periods: threshold of non-null data points to require (otherwise result is NA)

- time_rule: optionally specify a time rule to pre-conform the data to

These functions can be applied to ndarrays or Series objects:

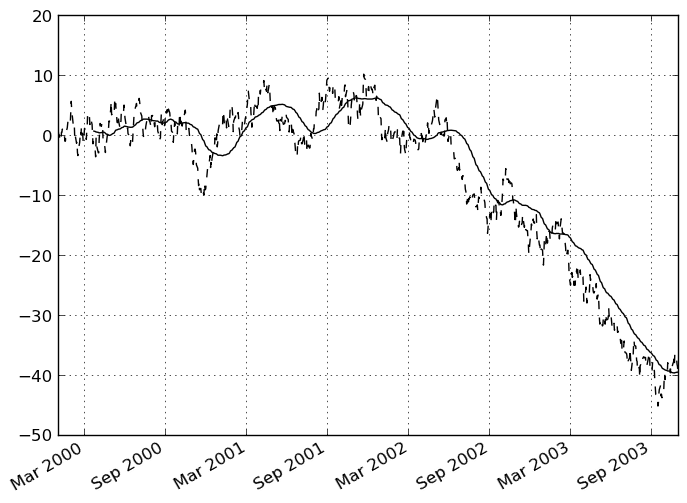

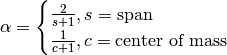

In [179]: ts = Series(randn(1000), index=DateRange('1/1/2000', periods=1000))

In [180]: ts = ts.cumsum()

In [181]: ts.plot(style='k--')

Out[181]: <matplotlib.axes.AxesSubplot at 0x10a7fdad0>

In [182]: rolling_mean(ts, 60).plot(style='k')

Out[182]: <matplotlib.axes.AxesSubplot at 0x10a7fdad0>

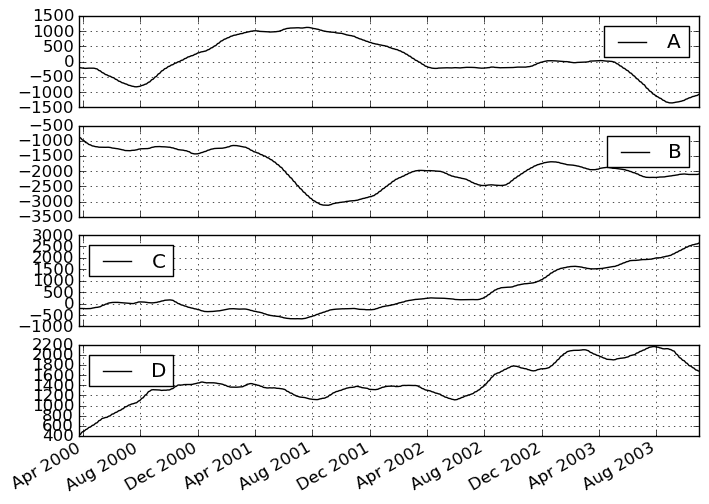

They can also be applied to DataFrame objects. This is really just syntactic sugar for applying the moving window operator to all of the DataFrame’s columns:

In [183]: df = DataFrame(randn(1000, 4), index=ts.index,

.....: columns=['A', 'B', 'C', 'D'])

In [184]: df = df.cumsum()

In [185]: rolling_sum(df, 60).plot(subplots=True)

Out[185]:

array([Axes(0.125,0.747826;0.775x0.152174),

Axes(0.125,0.565217;0.775x0.152174),

Axes(0.125,0.382609;0.775x0.152174), Axes(0.125,0.2;0.775x0.152174)], dtype=object)

Binary rolling moments¶

rolling_cov and rolling_corr can compute moving window statistics about two Series or any combination of DataFrame/Series or DataFrame/DataFrame. Here is the behavior in each case:

- two Series: compute the statistic for the pairing

- DataFrame/Series: compute the statistics for each column of the DataFrame with the passed Series, thus returning a DataFrame

- DataFrame/DataFrame: compute statistic for matching column names, returning a DataFrame

For example:

In [186]: df2 = df[:20]

In [187]: rolling_corr(df2, df2['B'], window=5)

Out[187]:

A B C D

2000-01-03 NaN NaN NaN NaN

2000-01-04 NaN NaN NaN NaN

2000-01-05 NaN NaN NaN NaN

2000-01-06 NaN NaN NaN NaN

2000-01-07 0.806980 1 -0.911973 -0.747745

2000-01-10 0.689915 1 -0.609054 -0.680394

2000-01-11 0.211679 1 -0.383565 -0.164879

2000-01-12 0.286270 1 0.104075 0.345844

2000-01-13 -0.565249 1 0.039148 0.333921

2000-01-14 0.295310 1 0.501143 -0.524100

2000-01-17 0.041252 1 0.868636 -0.577590

2000-01-18 0.205705 1 0.917778 -0.819271

2000-01-19 0.326449 1 0.933352 -0.882750

2000-01-20 0.120893 1 0.409255 -0.795062

2000-01-21 0.680531 1 -0.192045 -0.349044

2000-01-24 0.643667 1 -0.588676 0.473287

2000-01-25 0.703188 1 -0.746130 0.714265

2000-01-26 0.065322 1 -0.209789 0.635360

2000-01-27 -0.429914 1 -0.100807 0.266005

2000-01-28 -0.387498 1 0.512321 0.592033

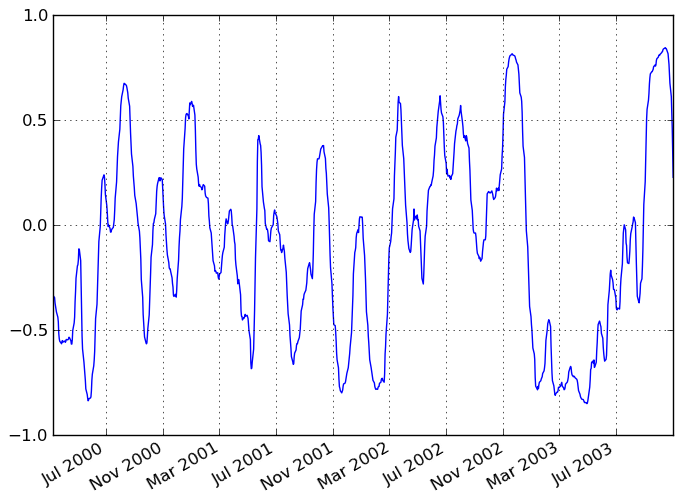

Computing rolling pairwise correlations¶

In financial data analysis and other fields it’s common to compute correlation matrices for a collection of time series. More difficult is to compute a moving-window correlation matrix. This can be done using the rolling_corr_pairwise function, which yields a Panel whose items are the dates in question:

In [188]: correls = rolling_corr_pairwise(df, 50)

In [189]: correls[df.index[-50]]

Out[189]:

A B C D

A 1.000000 -0.177708 -0.253742 0.303872

B -0.177708 1.000000 -0.085484 0.008572

C -0.253742 -0.085484 1.000000 -0.769233

D 0.303872 0.008572 -0.769233 1.000000

You can efficiently retrieve the time series of correlations between two columns using ix indexing:

In [190]: correls.ix[:, 'A', 'C'].plot()

Out[190]: <matplotlib.axes.AxesSubplot at 0x10a9e6390>

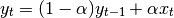

Exponentially weighted moment functions¶

A related set of functions are exponentially weighted versions of many of the

above statistics. A number of EW (exponentially weighted) functions are

provided using the blending method. For example, where  is the

result and

is the

result and  the input, we compute an exponentially weighted moving

average as

the input, we compute an exponentially weighted moving

average as

One must have  , but rather than pass

, but rather than pass  directly, it’s easier to think about either the span or center of mass

(com) of an EW moment:

directly, it’s easier to think about either the span or center of mass

(com) of an EW moment:

You can pass one or the other to these functions but not both. Span corresponds to what is commonly called a “20-day EW moving average” for example. Center of mass has a more physical interpretation. For example, span = 20 corresponds to com = 9.5. Here is the list of functions available:

| Function | Description |

|---|---|

| ewma | EW moving average |

| ewvar | EW moving variance |

| ewstd | EW moving standard deviation |

| ewmcorr | EW moving correlation |

| ewmcov | EW moving covariance |

Here are an example for a univariate time series:

In [191]: plt.close('all')

In [192]: ts.plot(style='k--')

Out[192]: <matplotlib.axes.AxesSubplot at 0x10e39ee50>

In [193]: ewma(ts, span=20).plot(style='k')

Out[193]: <matplotlib.axes.AxesSubplot at 0x10e39ee50>

Note

The EW functions perform a standard adjustment to the initial observations whereby if there are fewer observations than called for in the span, those observations are reweighted accordingly.

Linear and panel regression¶

Note

We plan to move this functionality to statsmodels for the next release. Some of the result attributes may change names in order to foster naming consistency with the rest of statsmodels. We will provide every effort to provide compatibility with older versions of pandas, however.

We have implemented a very fast set of moving-window linear regression classes in pandas. Two different types of regressions are supported:

- Standard ordinary least squares (OLS) multiple regression

- Multiple regression (OLS-based) on panel data including with fixed-effects (also known as entity or individual effects) or time-effects.

Both kinds of linear models are accessed through the ols function in the pandas namespace. They all take the following arguments to specify either a static (full sample) or dynamic (moving window) regression:

- window_type: 'full sample' (default), 'expanding', or rolling

- window: size of the moving window in the window_type='rolling' case. If window is specified, window_type will be automatically set to 'rolling'

- min_periods: minimum number of time periods to require to compute the regression coefficients

Generally speaking, the ols works by being given a y (response) object and an x (predictors) object. These can take many forms:

- y: a Series, ndarray, or DataFrame (panel model)

- x: Series, DataFrame, dict of Series, dict of DataFrame or Panel

Based on the types of y and x, the model will be inferred to either a panel model or a regular linear model. If the y variable is a DataFrame, the result will be a panel model. In this case, the x variable must either be a Panel, or a dict of DataFrame (which will be coerced into a Panel).

Standard OLS regression¶

Let’s pull in some sample data:

In [194]: from pandas.io.data import DataReader

In [195]: symbols = ['MSFT', 'GOOG', 'AAPL']

In [196]: data = dict((sym, DataReader(sym, "yahoo"))

.....: for sym in symbols)

In [197]: panel = Panel(data).swapaxes('items', 'minor')

In [198]: close_px = panel['Close']

# convert closing prices to returns

In [199]: rets = close_px / close_px.shift(1) - 1

In [200]: rets.info()

<class 'pandas.core.frame.DataFrame'>

Index: 250 entries, 2011-11-09 00:00:00 to 2012-11-07 00:00:00

Data columns:

AAPL 249 non-null values

GOOG 249 non-null values

MSFT 249 non-null values

dtypes: float64(3)

Let’s do a static regression of AAPL returns on GOOG returns:

In [201]: model = ols(y=rets['AAPL'], x=rets.ix[:, ['GOOG']])

In [202]: model

Out[202]:

-------------------------Summary of Regression Analysis-------------------------

Formula: Y ~ <GOOG> + <intercept>

Number of Observations: 249

Number of Degrees of Freedom: 2

R-squared: 0.1691

Adj R-squared: 0.1658

Rmse: 0.0157

F-stat (1, 247): 50.2798, p-value: 0.0000

Degrees of Freedom: model 1, resid 247

-----------------------Summary of Estimated Coefficients------------------------

Variable Coef Std Err t-stat p-value CI 2.5% CI 97.5%

--------------------------------------------------------------------------------

GOOG 0.4791 0.0676 7.09 0.0000 0.3466 0.6115

intercept 0.0013 0.0010 1.28 0.2012 -0.0007 0.0032

---------------------------------End of Summary---------------------------------

In [203]: model.beta

Out[203]:

GOOG 0.479054

intercept 0.001278

If we had passed a Series instead of a DataFrame with the single GOOG column, the model would have assigned the generic name x to the sole right-hand side variable.

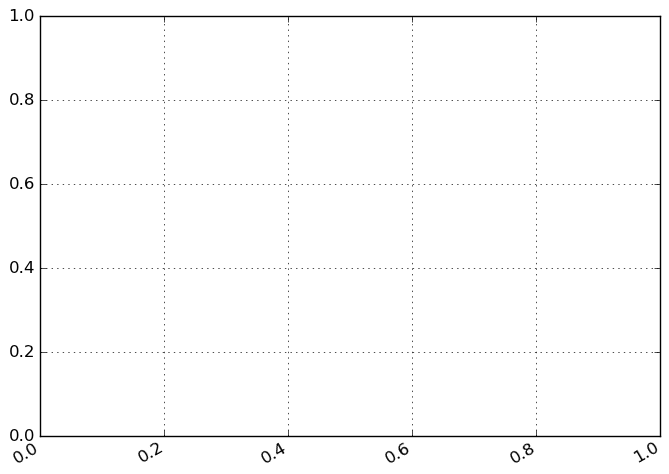

We can do a moving window regression to see how the relationship changes over time:

In [204]: model = ols(y=rets['AAPL'], x=rets.ix[:, ['GOOG']],

.....: window=250)

# just plot the coefficient for GOOG

In [205]: model.beta['GOOG'].plot()

Out[205]: <matplotlib.axes.AxesSubplot at 0x110761190>

It looks like there are some outliers rolling in and out of the window in the above regression, influencing the results. We could perform a simple winsorization at the 3 STD level to trim the impact of outliers:

In [206]: winz = rets.copy()

In [207]: std_1year = rolling_std(rets, 250, min_periods=20)

# cap at 3 * 1 year standard deviation

In [208]: cap_level = 3 * np.sign(winz) * std_1year

In [209]: winz[np.abs(winz) > 3 * std_1year] = cap_level

In [210]: winz_model = ols(y=winz['AAPL'], x=winz.ix[:, ['GOOG']],

.....: window=250)

In [211]: model.beta['GOOG'].plot(label="With outliers")

Out[211]: <matplotlib.axes.AxesSubplot at 0x1107671d0>

In [212]: winz_model.beta['GOOG'].plot(label="Winsorized"); plt.legend(loc='best')

Out[212]: <matplotlib.legend.Legend at 0x111a51390>

So in this simple example we see the impact of winsorization is actually quite significant. Note the correlation after winsorization remains high:

In [213]: winz.corrwith(rets)

Out[213]:

AAPL 0.991873

GOOG 0.984418

MSFT 0.998519

Multiple regressions can be run by passing a DataFrame with multiple columns for the predictors x:

In [214]: ols(y=winz['AAPL'], x=winz.drop(['AAPL'], axis=1))

Out[214]:

-------------------------Summary of Regression Analysis-------------------------

Formula: Y ~ <GOOG> + <MSFT> + <intercept>

Number of Observations: 249

Number of Degrees of Freedom: 3

R-squared: 0.2347

Adj R-squared: 0.2285

Rmse: 0.0144

F-stat (2, 246): 37.7281, p-value: 0.0000

Degrees of Freedom: model 2, resid 246

-----------------------Summary of Estimated Coefficients------------------------

Variable Coef Std Err t-stat p-value CI 2.5% CI 97.5%

--------------------------------------------------------------------------------

GOOG 0.4502 0.0712 6.32 0.0000 0.3107 0.5897

MSFT 0.2654 0.0748 3.55 0.0005 0.1188 0.4120

intercept 0.0009 0.0009 0.94 0.3482 -0.0009 0.0027

---------------------------------End of Summary---------------------------------

Panel regression¶

We’ve implemented moving window panel regression on potentially unbalanced panel data (see this article if this means nothing to you). Suppose we wanted to model the relationship between the magnitude of the daily return and trading volume among a group of stocks, and we want to pool all the data together to run one big regression. This is actually quite easy:

# make the units somewhat comparable

In [215]: volume = panel['Volume'] / 1e8

In [216]: model = ols(y=volume, x={'return' : np.abs(rets)})

In [217]: model

Out[217]:

-------------------------Summary of Regression Analysis-------------------------

Formula: Y ~ <return> + <intercept>

Number of Observations: 747

Number of Degrees of Freedom: 2

R-squared: 0.0244

Adj R-squared: 0.0231

Rmse: 0.2105

F-stat (1, 745): 18.6418, p-value: 0.0000

Degrees of Freedom: model 1, resid 745

-----------------------Summary of Estimated Coefficients------------------------

Variable Coef Std Err t-stat p-value CI 2.5% CI 97.5%

--------------------------------------------------------------------------------

return 3.1731 0.7349 4.32 0.0000 1.7327 4.6136

intercept 0.1888 0.0111 16.95 0.0000 0.1670 0.2107

---------------------------------End of Summary---------------------------------

In a panel model, we can insert dummy (0-1) variables for the “entities” involved (here, each of the stocks) to account the a entity-specific effect (intercept):

In [218]: fe_model = ols(y=volume, x={'return' : np.abs(rets)},

.....: entity_effects=True)

In [219]: fe_model

Out[219]:

-------------------------Summary of Regression Analysis-------------------------

Formula: Y ~ <return> + <FE_GOOG> + <FE_MSFT> + <intercept>

Number of Observations: 747

Number of Degrees of Freedom: 4

R-squared: 0.7843

Adj R-squared: 0.7834

Rmse: 0.0991

F-stat (3, 743): 900.6175, p-value: 0.0000

Degrees of Freedom: model 3, resid 743

-----------------------Summary of Estimated Coefficients------------------------

Variable Coef Std Err t-stat p-value CI 2.5% CI 97.5%

--------------------------------------------------------------------------------

return 4.0218 0.3483 11.55 0.0000 3.3392 4.7044

FE_GOOG -0.1396 0.0089 -15.66 0.0000 -0.1571 -0.1221

FE_MSFT 0.3052 0.0089 34.16 0.0000 0.2877 0.3227

intercept 0.1244 0.0077 16.24 0.0000 0.1093 0.1394

---------------------------------End of Summary---------------------------------

Because we ran the regression with an intercept, one of the dummy variables must be dropped or the design matrix will not be full rank. If we do not use an intercept, all of the dummy variables will be included:

In [220]: fe_model = ols(y=volume, x={'return' : np.abs(rets)},

.....: entity_effects=True, intercept=False)

In [221]: fe_model

Out[221]:

-------------------------Summary of Regression Analysis-------------------------

Formula: Y ~ <return> + <FE_AAPL> + <FE_GOOG> + <FE_MSFT>

Number of Observations: 747

Number of Degrees of Freedom: 4

R-squared: 0.7843

Adj R-squared: 0.7834

Rmse: 0.0991

F-stat (4, 743): 900.6175, p-value: 0.0000

Degrees of Freedom: model 3, resid 743

-----------------------Summary of Estimated Coefficients------------------------

Variable Coef Std Err t-stat p-value CI 2.5% CI 97.5%

--------------------------------------------------------------------------------

return 4.0218 0.3483 11.55 0.0000 3.3392 4.7044

FE_AAPL 0.1244 0.0077 16.24 0.0000 0.1093 0.1394

FE_GOOG -0.0153 0.0073 -2.10 0.0358 -0.0295 -0.0010

FE_MSFT 0.4295 0.0071 60.08 0.0000 0.4155 0.4436

---------------------------------End of Summary---------------------------------

We can also include time effects, which demeans the data cross-sectionally at each point in time (equivalent to including dummy variables for each date). More mathematical care must be taken to properly compute the standard errors in this case:

In [222]: te_model = ols(y=volume, x={'return' : np.abs(rets)},

.....: time_effects=True, entity_effects=True)

In [223]: te_model

Out[223]:

-------------------------Summary of Regression Analysis-------------------------

Formula: Y ~ <return> + <FE_GOOG> + <FE_MSFT>

Number of Observations: 747

Number of Degrees of Freedom: 252

R-squared: 0.8445

Adj R-squared: 0.7656

Rmse: 0.0979

F-stat (3, 495): 10.7076, p-value: 0.0000

Degrees of Freedom: model 251, resid 495

-----------------------Summary of Estimated Coefficients------------------------

Variable Coef Std Err t-stat p-value CI 2.5% CI 97.5%

--------------------------------------------------------------------------------

return 3.4851 0.4777 7.30 0.0000 2.5488 4.4214

FE_GOOG -0.1408 0.0088 -15.94 0.0000 -0.1581 -0.1235

FE_MSFT 0.3037 0.0089 34.24 0.0000 0.2863 0.3211

---------------------------------End of Summary---------------------------------

Here the intercept (the mean term) is dropped by default because it will be 0 according to the model assumptions, having subtracted off the group means.

Result fields and tests¶

We’ll leave it to the user to explore the docstrings and source, especially as we’ll be moving this code into statsmodels in the near future.